4 Ways To Combat Churn: The #1 Silent Killer For Every Subscription-based Business

By Rodney Laws | Ecommerce

By Rodney Laws | Ecommerce

More often than not businesses tend to invest in customer acquisition tactics.

While growth is of course important, it’s possible if your customers are leaving faster than they come. This is why prioritising your customer retention is so important — and this is where the concept of “churn” comes into play.

Churn (also referred to as attrition) is the percentage of customers who cancel or choose not to renew their subscriptions. Put simply, churn reflects the proportion of lost accounts during a given period of time.

It is a very important metric as it reflects the health of the customer base and reveals the performance of the business.

Churn indicates brand loyalty and customer satisfaction as well as presents “lost revenue”.

Customer churn is claimed to cost US businesses a whopping $136 billion a year. Yet, there is no clear consensus as to how to calculate it.

The easiest (and most common) way to estimate churn is to take the number of users you lost within a set time period (e.g. monthly or quarterly) and divide it by the total number of customers at the beginning of that time period.

In reality, businesses may prefer to focus on different types of churn:

Here are a few more slightly different formulas if you need more information (including formulas):

Customer churn:

Revenue churn:

Regardless of how you calculate churn, your company’s focus should be reducing it, and the strategy may be the same for each type.

Obviously, where there’s no uniform way to calculate churn, there’s no such a thing as optimal (normal) churn.

Zero churn is hardly possible because there are too many factors that can fail here: credit cards expire, people move or quit, customers move on to different tasks and simply don’t need your product any more.

According to various studies, few companies see churn which is less than 5 per cent. But that is not to say that you have nothing to work on if your customer churn is 4%. In this area, there’s always room for improvement.

Here are four steps to prioritise:

Set up an effective dunning management routine

Dunning management refers to all kinds of methods a business is using to handle failed credit card payments.

A credit card payment may be declined for a variety of reasons, including:

It has been calculated that on average 12% of monthly credit cards will fail. This means that unless you manage these failed payments to revive them, your churn will be a minimum of 12%,

Coming from the same source, there are other astounding stats: only around 15% of failed payments are recovered every month.

There are a few (pretty easy) ways to recover failed payments:

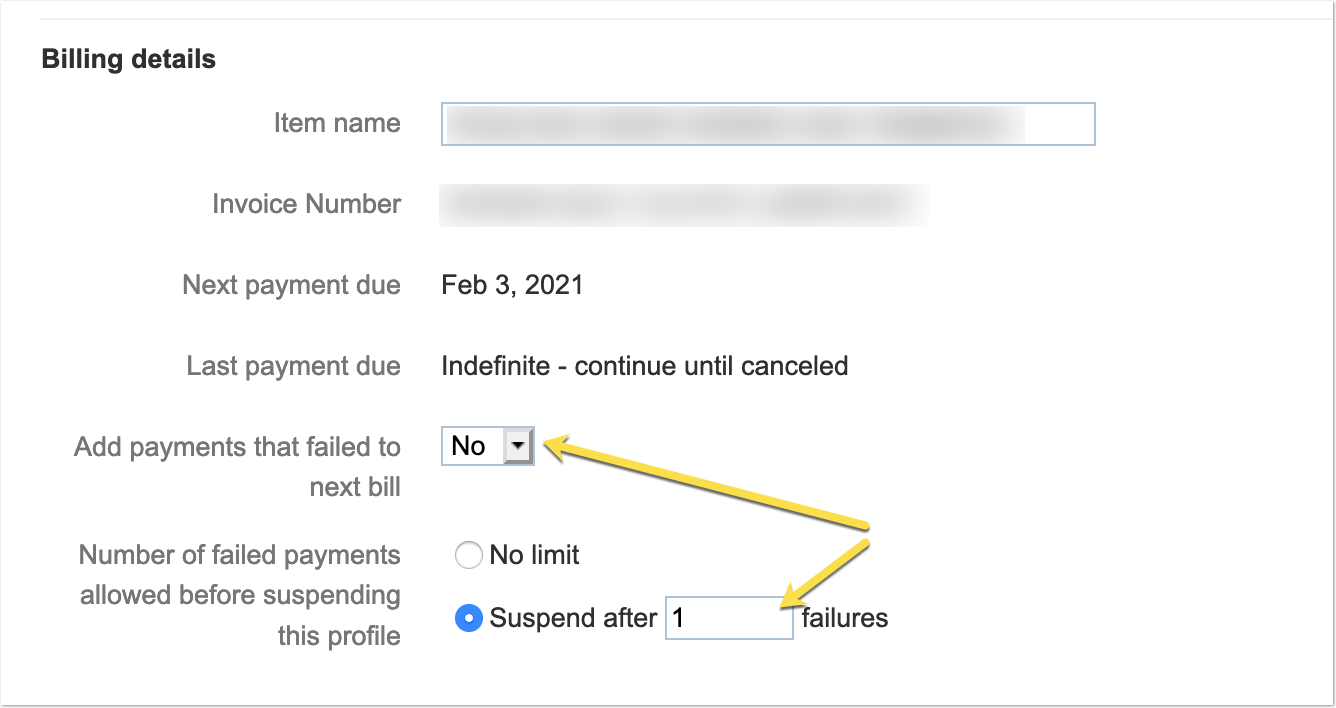

Again, most payment processors will offer this as an option, so make sure you have it activated. PayPal lets you set a failure threshold for a plan as well as recover outstanding balances, for example, both of these options an be accessed from your PayPal recurring payment dashboards:

Image: paypal.com

PayKickstart is one example of a payment management solution that allows users to customise the action to be taken when a payment fails as well as edit the email template that goes out to the customer.

Don’t cancel your customer’s account right away: This can result in unnecessary frustration and lost accounts. Instead, send a series of emails to a customer notifying of a failed payment prior to cancelling.

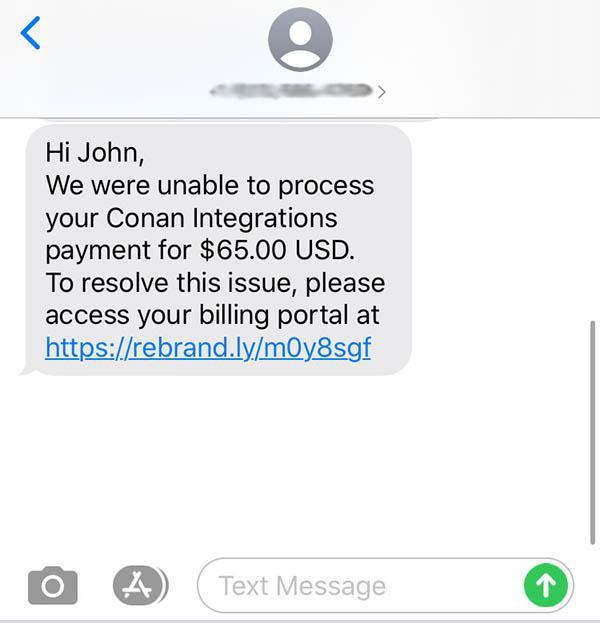

Emails get filtered by spam boxes, people forget to check one of their inboxes or they simply never notice yours in the list.

To overcome possible communication failures, use an alternative method of getting in touch with your users. Invite them to opt-in for text messages, phone calls or push notifications. Also, mention that it is very important for them to get notified when something goes on with their accounts.

Image: rebrand.ly

Not all churn happens because of failed payments. Some of it occurs when your customer actually cancels their accounts.

But even in those cases, much of that churn can be prevented.

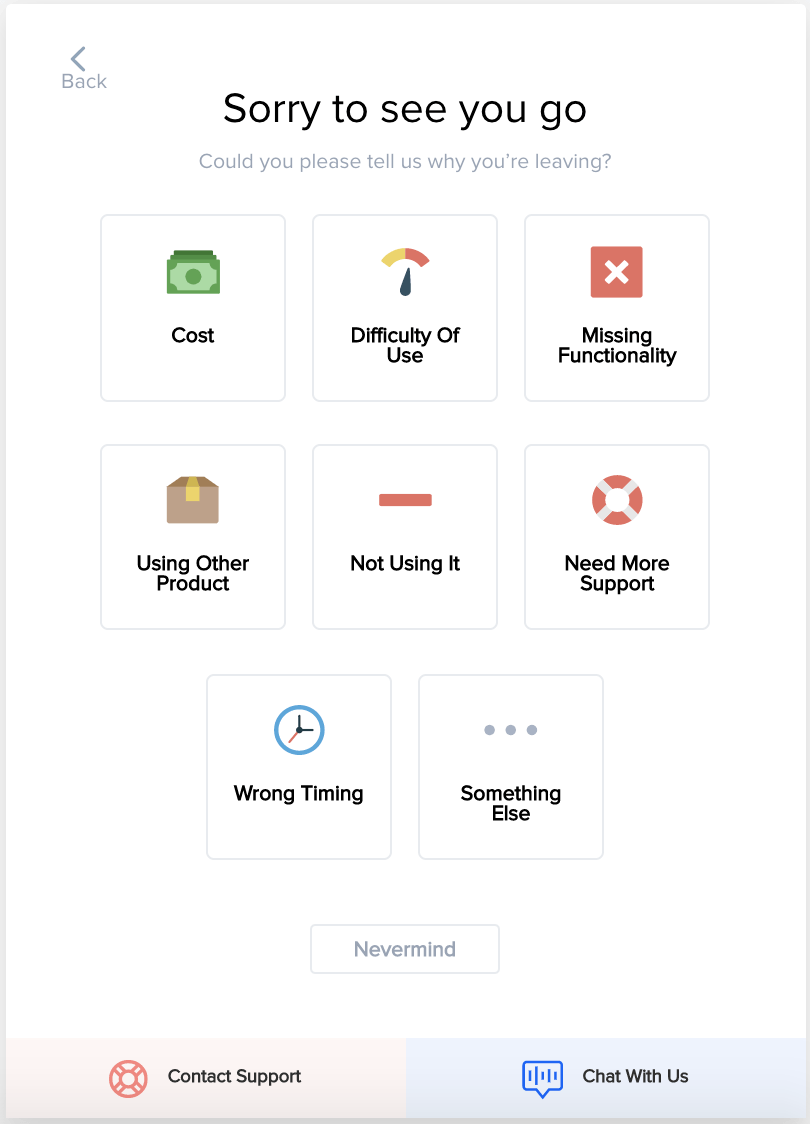

This is where cancellation saver sequences come into play. This is what it usually looks like:

Image: paykickstart.com

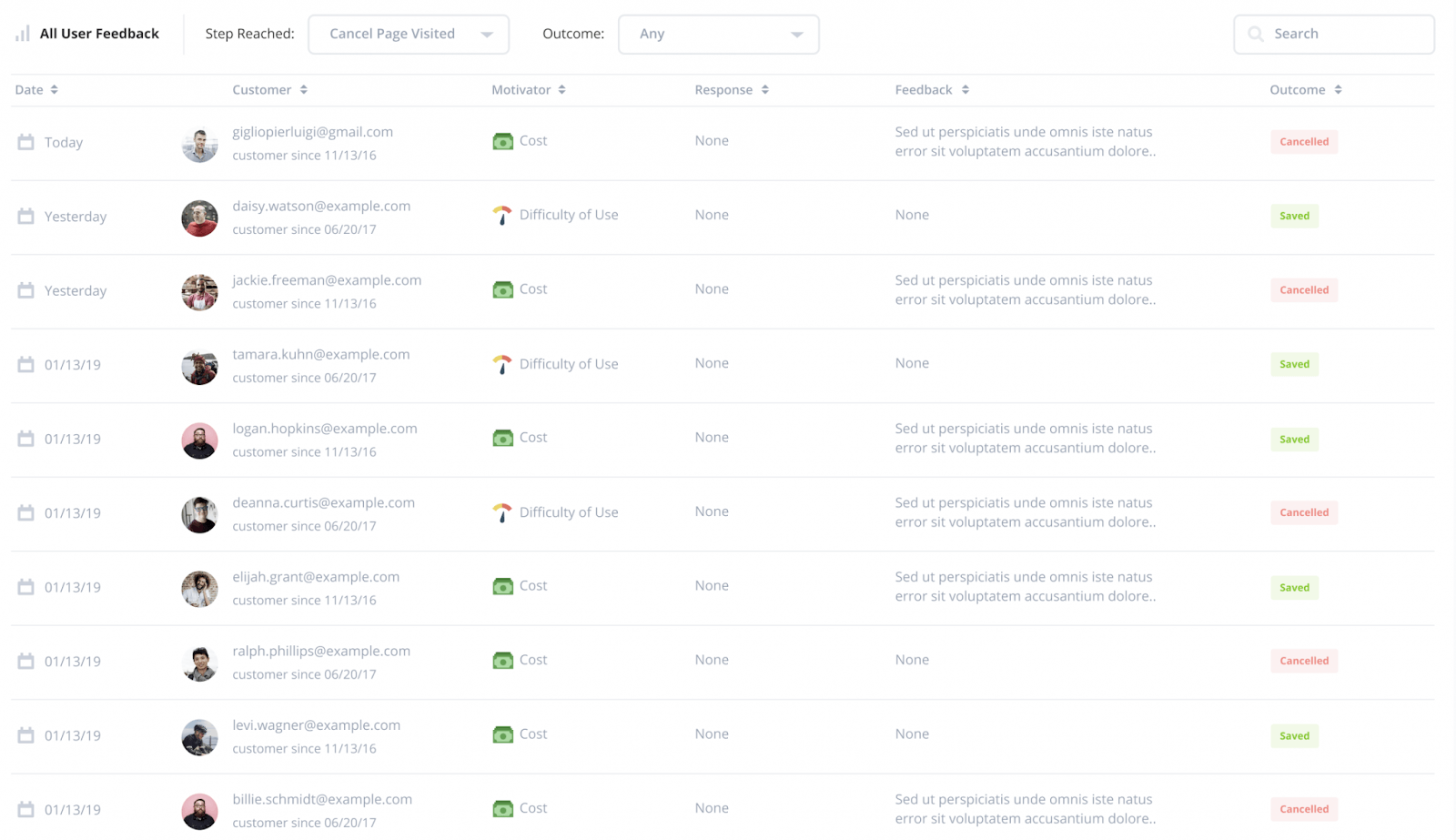

According to PayKickstart, businesses are able to save 30-50% of cancellations by using the cancellation saver option which is included in the revenue retention toolset. The feature also allows you to identify the most common reasons for cancelling and helps you adjust your product to eliminate those:

Image Credit: paykickstart.com

If churn happens because of a payment failure, it’s often the payment processor’s fault. It might not support the customer’s country, or fails to connect to the customer’s bank account. In this case, it’s beyond your customer’s power to solve this unless there’s an alternative method offered.

Customers may abandon checkout due to missing payment options, so offering several options is important for your conversion rates. But this also helps in reducing churn when a customer’s current method fails.

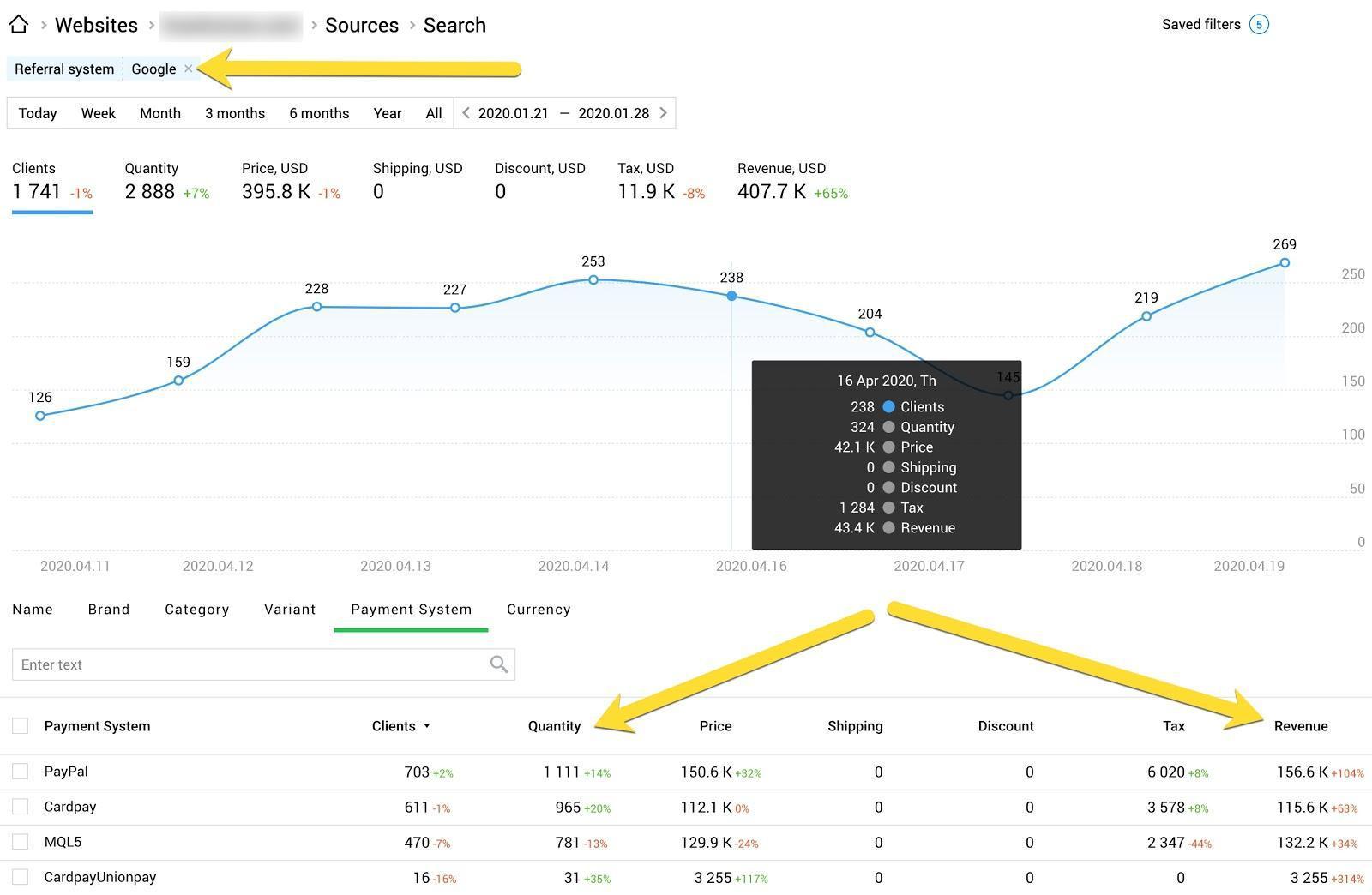

Diversifying payment methods will also give you more data to process. Tools like Finteza offer in-depth analytics on which payment methods work better.

With Finteza you can slice and dice your data to identify:

(Payment method analytics based on traffic source, i.e. Google search)

Image: Finteza.com

Knowing your customers’ struggles is the best way to reduce churn.

Customers’ feedback will allow you to solve their problems before they are forced to cancel, but don’t expect your users to come to you with their problems.

Only one in 26 customers are said to complain when they are unhappy. All the remainder churn quietly, without saying a word, unless you prompt them to share their feedback.

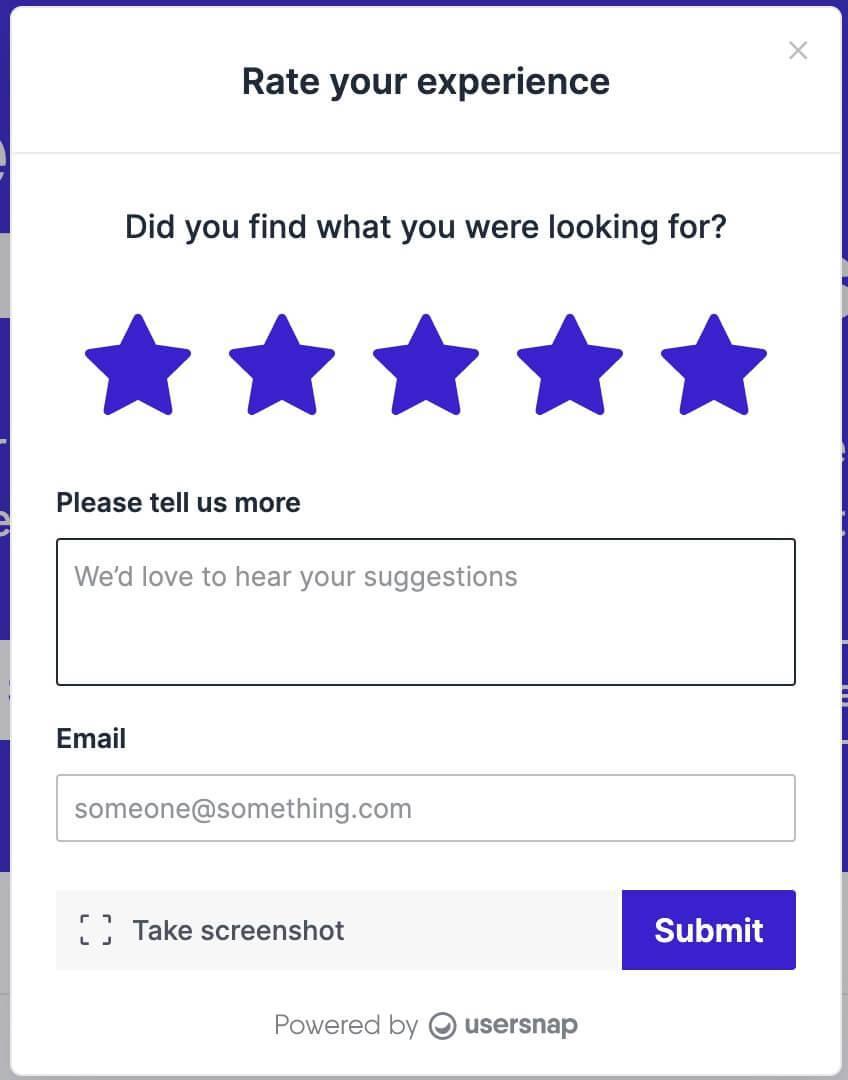

These days there are multiple easily-integrated feedback sharing solutions that will allow you to hear from your customers on a daily basis. These include plugins, feedback widgets, smart chatbots, and yes, cancellation saver sequence we discussed above.

Image: usersnap.com

The good news, happier customers don’t just cancel less. Happy customers mean loyal customers and the benefits don’t stop there:

Churn reflects the company’s ability to keep its customers which makes it the foundation of any company’s success. If you are not monitoring churn or working on reducing it, I hope the above tools and tips will help!

Author Bio: Mark Thompson is the co-founder of PayKickstart an industry-leading billing and affiliate management platform for subscription-based businesses. Mark loves the subscription-economy and helping startups and mature businesses maximise revenue. As a 10-year online Entrepreneur, he has sold multiple 6 and 7 figure businesses, while generating over $20M dollars online.